Cryptocurrency

From Skepticism to Assurance: Understanding Minethrive Legit

Since its launch in 2009, Bitcoin has grown into the dominant cryptocurrency, with a market cap exceeding $600 billion as of 2022. Underpinning Bitcoin’s functionality and value is the process of mining, whereby specialized computers compete to validate transactions and mint new bitcoins by solving complex cryptographic puzzles.

In the early years, hobbyists could mine bitcoin from home PCs, but the difficulty has long surpassed everyday computing power. Professional mining today requires warehouses of specialized ASIC hardware, consuming enormous amounts of electricity. This high barrier excludes casual cryptocurrency enthusiasts from participating.

Cloud mining services like minethrive legit promise to make bitcoin mining accessible by allowing customers to rent remote mining power and earn bitcoin without running their rigs. But are these services legit and profitable?

Minethrive Legit Technology Fundamentals

Bitcoin functions as decentralized digital cash powered by blockchain technology. Here is a quick primer:

– Bitcoin network runs via distributed nodes, not any centralized entity

– Nodes maintain a shared public ledger of all transactions called the blockchain

– New transactions are verified by miners and added in “blocks.”

– Miners use specialized hardware to solve complex math puzzles and validate blocks

– The protocol rewards successful miners with newly minted bitcoin

– The system is secured cryptographically through public/private key pairs

– Supply is limited to 21 million bitcoins released gradually through mining

This “digital gold” created the foundation for cryptocurrencies. The ability to send money online without central banks or intermediaries has ignited enormous demand. Now, let’s examine how Bitcoin mining secures the network.

How Bitcoin Mining Works

Bitcoin mining serves two crucial functions:

1. Verifying transactions and recording them via adding new blocks

2. Issuing new bitcoin into circulation as mining rewards

Here are the basics of how Bitcoin mining functions:

– Miners assemble pending transactions into candidate blocks

– Miners repeatedly hash the block header, trying to get a result below the target difficulty

– The first miner to solve the cryptographic puzzle announces the block to the network

– Other nodes verify the block is valid and meets the difficulty criteria

– The new block is added to the existing blockchain

– The miner who mined the block is rewarded with newly minted bitcoin

This competitive process ensures transactions are verified in a decentralized manner. It also distributes new bitcoin into the money supply on a schedule encoded into the protocol.

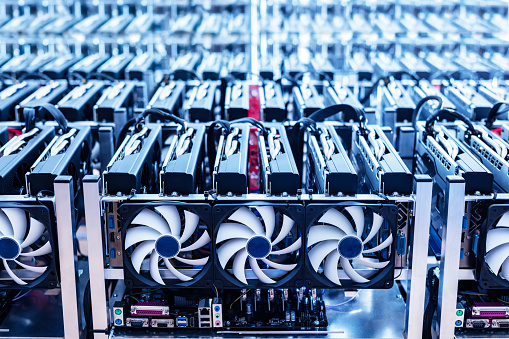

The Evolution of Bitcoin Mining Hardware

In Bitcoin’s early days, the network hash rate was low enough for regular home computers to profitably mine Bitcoin with their CPUs. But equipment and technology advanced rapidly:

CPU Mining – Using customary computer central processing units was feasible until 2010.

GPU Mining – Graphics processing units offered 50-100x more mining power efficiency. Bitcoin ASICs soon outpaced GPUs.

FPGA Mining – Custom field-programmable gate arrays delivered better performance than GPUs but cost more.

ASIC Mining – Application-specific integrated circuits are chips customized solely for Bitcoin mining. ASIC rig farms now dominate.

Better Hash Algorithms – Some newer cryptocurrencies use memory-hard hashes that resist ASICs to preserve decentralization.

But for Bitcoin, ever-increasing mining difficulty now necessitates specialized ASIC hardware storing hundreds of specialized mining chips in massive warehouses. Solo home PC mining is no longer viable.

Cloud Mining Overview

Cloud mining allows individuals to pay for a service provider’s remote data center mining capacity. Instead of buying, configuring, and maintaining expensive mining rigs, users can purchase hash rate contracts and receive bitcoin without dealing with the hardware.

Here are the basics of how most Bitcoin cloud mining services work:

– Users sign up and purchase contracts for fixed amounts of hashing power

– The hash rates are pointed at mining Bitcoin under the provider’s account

– As the ASIC rigs generate bitcoin, proceeds are shared among users based on their share of hashpower

– Earnings are deposited regularly (often daily) into the user’s account

– Fees are deducted for electricity and maintenance costs

– When the contract expires, users can reinvest proceeds into more hashrate

Cloud mining opens up Bitcoin mining to anyone needing technical expertise or large capital expenditures. But there are downsides to consider:

Lower Earning Potential – Rewards must be split with the provider versus owning your hardware.

Contract Unprofitability – Contracts can lose money if bitcoin price drops or mining difficulty rises enough.

Scams – Cloud mining lacks regulation, so scams are common. Due diligence is critical.

Lack of Control – Need more visibility into actual mining operations and cannot audit practices.

Let’s look at one of the largest providers, Minethrive, to understand their services.

Inside Minethrive: Company Background

Minethrive launched in 2018 as one of the earliest legitimate cloud mining companies. They have served over 115,000 users with mining facilities spanning several countries.

Here are some key facts about their organization:

– Based in the UK with registration #11775383

The leadership team has decades of blockchain and engineering experience

– Backed by sizable venture capital investment

– Operates 20+ megawatts of data centers located in Iceland, Georgia, Canada, and Ukraine

– Utilizes the latest hardware from Bitmain, MicroBT, and other top mining equipment makers

– Mines a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Dogecoin, and more emerging coins

– Services over 100,000 users in 180 countries supported in multiple languages

While no cloud mining provider is risk-free, Minethrive strives to be transparent and reputable in a sector rife with scams. They have built a positive community reputation thus far. But always conduct your detailed due diligence before investing.

Estimating Potential Profits from Minethrive Cloud Mining

When considering any mining investment, it’s critical to estimate potential returns to assess viability and payback timeframes. Here are some tips for projecting possible Bitcoin profits with Minethrive:

Use mining calculators – Input hash rate, hardware cost, power costs, and other parameters to model possible yields.

Review Minethrive projections – Each contract states expected mining outputs at the time of purchase. Treat these as rough estimates.

Factor in pool fees – Account for Minethrive’s 15% maintenance fee deducted from mining proceeds before payouts.

Assume a flat BTC price – Use a conservatively low static bitcoin price rather than rely on appreciation. Any future gains are upside.

Account for increasing difficulty – The Bitcoin network difficulty adjusts upwards frequently. Model gradual difficulty increases into long-term projections.

Compare hardware mining costs – Evaluate whether contract costs deliver a competitive or better effective hash rate than operating your ASICs.

Start small – Don’t commit massive amounts upfront. Test with a low-tier contract and increase allocation once satisfied.

By combining prudent assumptions into profitability estimates, you can assess potential ROI timeframes and yields for Minethrive’s Bitcoin cloud mining packages.

Getting Started with Minethrive

If you decide to try Bitcoin cloud mining with Minethrive, here is an overview of the process:

1. Visit Minethrive.io and register for an account

2. Confirm your email and complete identity verification

3. Review the contract options and decide on a package

4. Select your preferred payment method and complete purchase

5. Your purchased hash rate immediately starts mining

6. Sit back and watch as mining proceeds accumulate in your account wallet

7. Withdraw to your Bitcoin wallet on your desired schedule

8. Consider reinvesting a portion of proceeds to grow your hashrate over time

It just takes a few minutes to get started with Bitcoin cloud mining. However, there are best practices to follow to maximize security and financial prudence.

Tips for Maximizing Cloud Mining Results

Here are some tips to optimize results and reduce risks when mining Bitcoin in the cloud with Minethrive:

– Enable two-factor authentication and use unique complex passwords

– Withdraw a portion of proceeds regularly to your secure wallet

– Split contract allocation between multiple hashrates and cryptocurrencies

– Reinvest wisely rather than unthinkingly reinvesting everything

– Only risk money you are willing to lose access to if a provider fails

– Discuss tax implications in your jurisdiction and set aside coins to pay taxes

– Carefully evaluate Minethrive’s partners, facilities, and business practices

– Start small and scale up over time once satisfied with the service

– Monitor mining metrics like bitcoin price and difficulty level

– Talk to Minethrive support promptly if any issues arise

Cloud mining could offer moderate rate rewards over time by applying security awareness and financial prudence. But risks around bitcoin’s volatile price swings and rising mining costs remain ever-present.

Bitcoin Mining Key Risks and Considerations

While Minethrive provides easy access to cloud mining, users should weigh risks before proceeding:

– Bitcoin price could drop sharply, making contracts unprofitable

– Increasing mining difficulty erodes profitability, especially in the long-term

– Minethrive could engage in dishonest practices like overselling hashrate

– Account hacking if security protocols aren’t followed

– Mining proceeds need to be withdrawn to personal wallets to avoid losses

– Mining income may be taxable in your jurisdiction

– Long contract lock-in periods with no ability to exit early

– No guarantee that Minethrive will deliver projected mining proceeds

These risks come with any cloud mining provider. Do extensive due diligence on Bitcoin mining track record and business practices before investing sizable sums. Start small to evaluate services firsthand.

Conclusion

Cloud mining with Minethrive offers a reasonably accessible avenue into Bitcoin mining without the daunting complexity and capital costs of operating ASIC rigs directly. It delegates the equipment, maintenance, facilities, and operations to professionals while users sit back collecting bitcoin.

However, prudent due diligence is required, as in any cryptocurrency investment. Realistically estimate profit scenarios, follow security protocols, and reinvest wisely. As part of a diversified crypto portfolio, cloud mining could yield moderate gains over the long term. Weigh the risks and rewards carefully based on Bitcoin’s fundamentals.

Hopefully, this guide provided a comprehensive introduction to bitcoin and cloud mining to empower investment decisions. Please reach out with any other questions!

Cryptocurrency

7 Main Benefits of Software that Deals with Crypto Tax, What It Is, How It Works?

As we know more people use digital money. It is hard to keep track of it. We need a report on how much you’ve made or lost for taxes. Crypto tax software is a special tool. It is made to make this easier. It helps you keep track of how much money you’ve made or lost from digital money. This also figures out how much tax you need to pay. It also tells you the rules you need to follow about taxes. Over all this software helps you do your taxes right.

How Does Crypto Tax Software Work?

Crypto tax software connects different places where you keep and trade your digital money. Here’s a simple way to understand.

Step 1. Bring in Your Data: People connect their digital money accounts to the software. The software collects details from all transactions. It can calculate things like buying and selling. It also deals with trading and moving money between wallets. This happens by linking accounts. There are special connections with all these transactions.

Step 2. Put It All Together: The software puts together all the information from different places. This makes sure nothing is missed. Everything is clear about what happened with the digital money.

Step 3. Sort Out the Transactions: It organizes transactions into groups. For example the ones that need to be taxed and the ones that don’t. The software uses the right tax rules for each group. This helps figure out how much tax is owed.

Step 4. Count the Gains and Losses: It can compare how much was spent to buy digital money with how much was made selling it. This software figures out if there was a gain or a loss for each transaction. This is really important to know how much tax needs to be paid.

Step 5. Make Tax Reports: The software creates detailed reports for taxes. For example the Form 8949 and Schedule D for people in the U.S. These reports show all the transactions. These all need to be taxed. This makes it easy to show tax authorities exactly what happened with the digital money.

7 Main Benefits of Using Crypto Tax Software

Accurate and Quick: Crypto tax software helps make sure your tax calculations are correct. It can lead to mistakes if you do it by hand lead to mistakes. The software does this automatically. So there are fewer mistakes. This is important when IRS watch crypto transactions closely.

Saves Time: Calculating crypto taxes by hand takes a lot of time. The software collects and organizes all the transactions for you. So you can do other things. This is really helpful for busy people. This saves the time that they would spend keeping records.

Easy Reporting: Tax reports can be hard without the right tools. Crypto tax software makes it easy. It can clear and simple reports that follow tax rules. You can use these reports with tax software. Or you can share them with tax experts. This is especially useful during tax season. In this you usually need everything to be correct and fast.

Following Tax Rules: Tax rules for cryptocurrencies keep changing. Crypto tax software stays updated with the latest rules. Make sure you follow them. This helps you avoid penalties and fines. It also saves you from making big mistakes. This software helps you manage your taxes confidently.

Help with Audits: During audit you need to have an organized record of all your crypto transactions. Crypto tax software keeps detailed records. This makes it easier to answer questions and give information to tax authorities. This support can be really helpful. It gives you a great peace of mind.

Supports Many Exchanges and Wallets: People who use crypto may have accounts in different places. Crypto tax software connects with many exchanges and wallets. It puts all transaction data in one place. This means you don’t have to enter data by hand. Great right? And no transaction is missed. It gives a clear view of all your crypto activities.

Tax Saving Tips: Well some advanced crypto tax software helps you find ways to save on taxes. It can be selling assets at a loss to reduce the tax you owe. These features can help you save a lot on taxes. So this software is a worth investment.

Shortly,

Keeping track of cryptocurrency taxes is really important for investors and traders. Crypto tax software helps make this job easier. It makes sure everything is accurate and follows the rules. It does this by automatic features. It gathers, organizes, and reports your transactions. This saves you a lot of time and effort.

The software also helps during audits. It also works with different exchanges. Moreover it gives you tips on saving money on taxes. This makes it a must-have tool for anyone using cryptocurrency. The right software helps you handle your crypto taxes confidently. With this you can make doing your taxes simpler. In your spare time you can focus on making the most of your investments!

SEE ALSO: Bitcoin Hits Two-Year Peak Of Over $56,000 Amidst Market Surge

Cryptocurrency

How Online Gaming Can Boost Your Cryptocurrency Portfolio

In recent years, the fusion of online gaming and cryptocurrency has created a revolutionary trend known as GameFi, transforming the way gamers and investors perceive digital assets. This new frontier offers gamers an exciting opportunity not only to enjoy their favorite pastime but also to grow their crypto portfolio.

If you’re an avid gamer, you should check out this opportunity to boost your cryptocurrency profile starting off with a new innovative game Hamster Kombat. Here’s how you can leverage GameFi to enhance your cryptocurrency holdings.

Understanding GameFi

GameFi, or “Game Finance,” merges the immersive world of online gaming with the lucrative potentials of blockchain and cryptocurrency. Unlike traditional games where in-game rewards are confined to the virtual environment, GameFi platforms reward players with crypto coins and NFTs (Non-Fungible Tokens), which hold real-world value. These rewards can be traded, sold, or invested, creating a dynamic ecosystem where gaming translates directly into financial gains.

The Mechanics of GameFi

GameFi operates on blockchain technology, ensuring that all transactions and in-game assets are secure and transparent. Players earn crypto coins through various in-game activities such as completing quests, winning battles, or achieving milestones. These digital assets can then be utilized in several ways, including trading on cryptocurrency exchanges, staking for additional rewards, or reinvesting in other GameFi projects.

The Role of Crypto Coins in GameFi

Crypto coins are the lifeblood of the GameFi ecosystem. These digital currencies are earned as rewards and can be used within the game for various purposes such as purchasing upgrades, participating in tournaments, or acquiring new assets. Importantly, these coins can also be exchanged for other cryptocurrencies or fiat money, allowing players to convert their gaming time into tangible financial benefits.

Benefits of GameFi for Gamers

The integration of GameFi into online gaming offers numerous advantages for gamers looking to enhance their cryptocurrency portfolios. Here are some key benefits:

1. Play-to-Earn Opportunities

The traditional gaming model requires players to spend money without any financial return. GameFi changes this by introducing the play-to-earn model, where gamers earn crypto coins simply by playing. This transforms gaming from a mere hobby into a potentially profitable venture.

2. Ownership and Control of Assets

In GameFi, players own their in-game assets through NFTs. This means that the money and effort invested in acquiring these assets are not wasted. Players can sell or trade their NFTs on various marketplaces, potentially making a profit from their gaming activities.

3. Financial Inclusion

GameFi democratizes access to financial growth, allowing gamers from all backgrounds to participate in the cryptocurrency economy. This inclusion provides more individuals with the opportunity to invest in and grow their crypto portfolios, regardless of their initial financial status.

4. Diversified Income Streams

By engaging in GameFi, gamers can diversify their income streams. In addition to traditional investments, they can earn cryptocurrencies through gaming, reducing their reliance on a single source of income and increasing their financial resilience.

Case Study: Hamster Kombat

One standout GameFi project that exemplifies these benefits is Hamster Kombat. This is a hamster-themed game where players can earn coins by tapping on the screen. Each tap earns the user virtual coins, which will be claimable through the game’s planned native token, HMSTR.

Earning with Hamster Kombat

In Hamster Kombat, players earn the game’s native token, HMSTR. These tokens can be used within the game for various purposes such as purchasing upgrades and entering tournaments. Importantly, it can be traded on cryptocurrency exchanges, enabling players to convert their in-game earnings into other cryptocurrencies or fiat money.

Financial Growth through Gameplay

Hamster Kombat exemplifies how gaming can lead to financial growth. By strategically participating in the game, players can accumulate valuable crypto coins and NFTs. These digital assets can be traded or sold, potentially yielding significant financial returns.

For example, a player who excels in battles and collects rare hamster NFTs might see their portfolio grow substantially over time.

How to Get Started with GameFi

For those new to GameFi, the prospect of turning gaming into investment opportunities may seem complex. However, the process is straightforward and accessible.

Step 1: Research and Choose a Game

Begin by researching various GameFi projects to find one that aligns with your interests and goals. Look for games with active communities, robust economies, and transparent reward systems. Hamster Kombat is an excellent choice due to its engaging gameplay and strong earning potential.

Step 2: Set Up a Crypto Wallet

To participate in GameFi, you’ll need a cryptocurrency wallet to store your earnings and in-game assets. Popular options include MetaMask, Trust Wallet, and Coinbase Wallet. Ensure your wallet supports the blockchain network used by your chosen game.

Step 3: Purchase Initial Assets

Some GameFi projects may require an initial investment to purchase in-game assets like NFTs. In Hamster Kombat, for instance, you may need to buy your first hamster NFT to start playing. These initial investments can often be recouped through gameplay earnings.

Step 4: Play and Earn

Once you have your wallet and assets ready, dive into the game. Engage in battles, complete missions, and participate in community events to maximize your earnings. Stay informed about the game’s economy to make strategic decisions regarding your assets.

Step 5: Trade and Invest

The crypto coins and NFTs earned through gameplay can be traded on various marketplaces and exchanges. Monitor market trends to sell or trade your assets at optimal times. Consider reinvesting your earnings into other promising GameFi projects to further diversify and grow your portfolio.

Conclusion

GameFi represents a transformative convergence of gaming and finance, offering gamers a unique pathway to financial growth. By participating in GameFi platforms like Hamster Kombat, players can turn their gaming skills and time into valuable cryptocurrency assets.

This play-to-earn model provides a compelling opportunity to enhance your cryptocurrency portfolio while enjoying immersive and engaging gameplay. Whether you’re a seasoned gamer or a newcomer to the world of cryptocurrencies, GameFi opens up a world of financial possibilities. Dive into this exciting realm and discover how your passion for gaming can translate into tangible financial rewards.

SEE ALSO: Epic Games Store Free Games Next Week Until 6th June, 2024

Cryptocurrency

The Dogecoin Revolution: How a Joke Became a Serious Cryptocurrency

Dogecoin, initially created as a joke, has evolved into a significant player in the cryptocurrency market. What began as a lighthearted response to the burgeoning cryptocurrency landscape has transformed into a digital asset with a dedicated community and substantial market value. This article delves into Dogecoin’s journey from a meme to a serious cryptocurrency, exploring its origins, community impact, technological features, and cultural significance. For those looking to understand the intricacies of this transformation, seeking guidance from an investment education firm like BitAMG can provide valuable insights.

The Genesis of Dogecoin

Dogecoin was launched on December 6, 2013, by software engineers Billy Markus and Jackson Palmer. Markus, an IBM engineer, and Palmer, an Adobe product manager, sought to create a fun and more approachable cryptocurrency. They chose the Shiba Inu dog from the popular “Doge” meme as the logo, emphasizing the coin’s humorous nature. Unlike Bitcoin, which was seen as a complex and serious investment, Dogecoin aimed to be more accessible and user-friendly.

Initially, Dogecoin was not intended to compete with Bitcoin or other established cryptocurrencies. Its primary purpose was to provide a light-hearted alternative, fostering an inclusive and engaging environment for newcomers to the crypto world.

The Role of Community in Dogecoin’s Development

Dogecoin’s success is largely attributed to its vibrant and dedicated community. The Dogecoin community is known for its strong sense of camaraderie and enthusiasm, which has played a crucial role in the coin’s development and adoption.

One notable example of community-driven initiatives is the Dogecoin sponsorship of the Jamaican bobsled team in 2014, raising $50,000 to help the team compete in the Sochi Winter Olympics. Another example is the “Doge4Water” campaign, which raised $30,000 to build clean water wells in Kenya. These initiatives highlight the community’s commitment to charitable causes and the power of collective action.

Dogecoin’s Unique Features and Technology

Dogecoin’s technology, while based on the same principles as other cryptocurrencies, has distinct characteristics that set it apart. Dogecoin is a decentralized, peer-to-peer digital currency that uses the Scrypt algorithm, unlike Bitcoin’s SHA-256. This allows for faster transaction times and lower fees.

One of Dogecoin’s most appealing features is its inflationary supply model. Unlike Bitcoin, which has a capped supply of 21 million coins, Dogecoin has no maximum supply limit. This ensures continuous mining rewards and a steady supply of new coins, encouraging spending and circulation rather than hoarding.

Additionally, Dogecoin’s block time is only one minute, compared to Bitcoin’s ten minutes. This results in quicker transaction confirmations, making Dogecoin more suitable for everyday transactions.

Dogecoin’s Rise to Prominence

Several key events have propelled Dogecoin into the mainstream spotlight. One of the most significant factors has been the endorsement and support from high-profile celebrities and influencers, most notably Elon Musk. Musk’s tweets and public statements about Dogecoin have often led to significant price surges and increased public interest.

In 2021, Dogecoin’s market capitalization soared, reaching an all-time high of over $88 billion in May. This rise was fueled by a combination of social media hype, celebrity endorsements, and increased trading activity on platforms like Robinhood and Coinbase.

The widespread media coverage and community-driven marketing efforts have also played a crucial role in Dogecoin’s rise. The “Doge Day” event on April 20, 2021, aimed to push Dogecoin’s price to new heights, demonstrating the power of collective action and social media influence.

The Transition to Seriousness

Dogecoin’s transition from a joke to a serious cryptocurrency can be attributed to several factors. Firstly, the coin’s growing adoption and integration into mainstream financial services have legitimized its use as a viable digital asset. Companies like Newegg, the Dallas Mavericks, and Kronos have started accepting Dogecoin as a form of payment, showcasing its utility in real-world transactions.

Secondly, the increasing attention from institutional investors has added credibility to Dogecoin. While initially dismissed as a speculative asset, the involvement of major investment firms and the listing on prominent cryptocurrency exchanges have validated Dogecoin’s potential as an investment.

Lastly, the community’s efforts to promote charitable causes and positive social impact have reshaped Dogecoin’s image. The coin is no longer seen solely as a meme but as a tool for philanthropy and community building.

Dogecoin’s Impact on Cryptocurrency Culture

Dogecoin’s influence extends beyond its market value; it has significantly impacted the broader cryptocurrency culture. Its success has challenged the notion that a cryptocurrency must be serious or technologically superior to succeed. Dogecoin’s rise has demonstrated the importance of community engagement, accessibility, and fun in driving adoption.

Moreover, Dogecoin has paved the way for other meme-based and community-driven cryptocurrencies, such as Shiba Inu (SHIB) and SafeMoon. These projects have followed in Dogecoin’s footsteps, leveraging humor and social media to build their communities and gain traction.

Dogecoin’s philanthropic initiatives have also inspired other cryptocurrency projects to focus on charitable giving and social impact. The emphasis on using cryptocurrency for good has resonated with many and has helped to foster a more positive and inclusive crypto culture.

Conclusion

Dogecoin’s journey from a joke to a serious cryptocurrency is a testament to the power of community, innovation, and accessibility. What started as a lighthearted experiment has evolved into a significant player in the digital currency landscape, challenging traditional perceptions of value and utility. As Dogecoin continues to gain traction and legitimacy, its story serves as a reminder of the diverse and dynamic nature of the cryptocurrency world. Whether as a tool for charitable causes, a medium of exchange, or a speculative investment, Dogecoin has carved out its unique niche, proving that sometimes, even the most unlikely contenders can make a lasting impact.

SEE ALSO: Bitcoin Hits Two-Year Peak Of Over $56,000 Amidst Market Surge

-

News3 years ago

News3 years agoLet’s Know About Ultra High Net Worth Individual

-

Entertainment1 year ago

Mabelle Prior: The Voice of Hope, Resilience, and Diversity Inspiring Generations

-

Health3 years ago

Health3 years agoHow Much Ivermectin Should You Take?

-

Tech2 years ago

Tech2 years agoTop Forex Brokers of 2023: Reviews and Analysis for Successful Trading

-

Lifestyles2 years ago

Lifestyles2 years agoAries Soulmate Signs

-

Health2 years ago

Health2 years agoCan I Buy Ivermectin Without A Prescription in the USA?

-

Movies2 years ago

Movies2 years agoWhat Should I Do If Disney Plus Keeps Logging Me Out of TV?

-

Learning2 years ago

Learning2 years agoVirtual Numbers: What Are They For?